Editor's Note

Federal investments are bringing billions of dollars into clean energy industries, creating good-paying jobs, lowering energy costs, and cutting pollution. But right now, those programs are under threat from both the Trump administration and Republicans in Congress. Our work isn’t done. In order to assist federal agencies, states, local communities, Tribal governments, businesses, and other partners to take full advantage of this funding, Evergreen has put together a collection of resources to help defend and implement key programs in the Inflation Reduction Act (IRA).

Complex, but packing a big punch, tax incentives for clean electricity represent a significant portion of the investments within President Biden’s landmark climate bill. Initial estimates stated that the IRA will deliver at least $370 billion in climate action, $257 billion of which comes from tax credits. Revised projections found that these investments could be three times greater than initially thought, or more—because the credits are uncapped, the only limit on their uptake is the public’s desire to take advantage of them.

Many of the credits go to consumers—a homeowner installing a new heat pump, for example, can take up to $2,000 of the appliance’s cost off their tax bill at the end of the year. But the credits that have the greatest impact to drive forward the clean energy transition will operate largely out of sight from consumers. The clean electricity production tax credit (PTC) and investment tax credit (ITC) fit that profile: lesser-known, but among the IRA’s highest-impact investments to spur a fair and equitable clean energy economy.

First, what are the ITC and PTC?

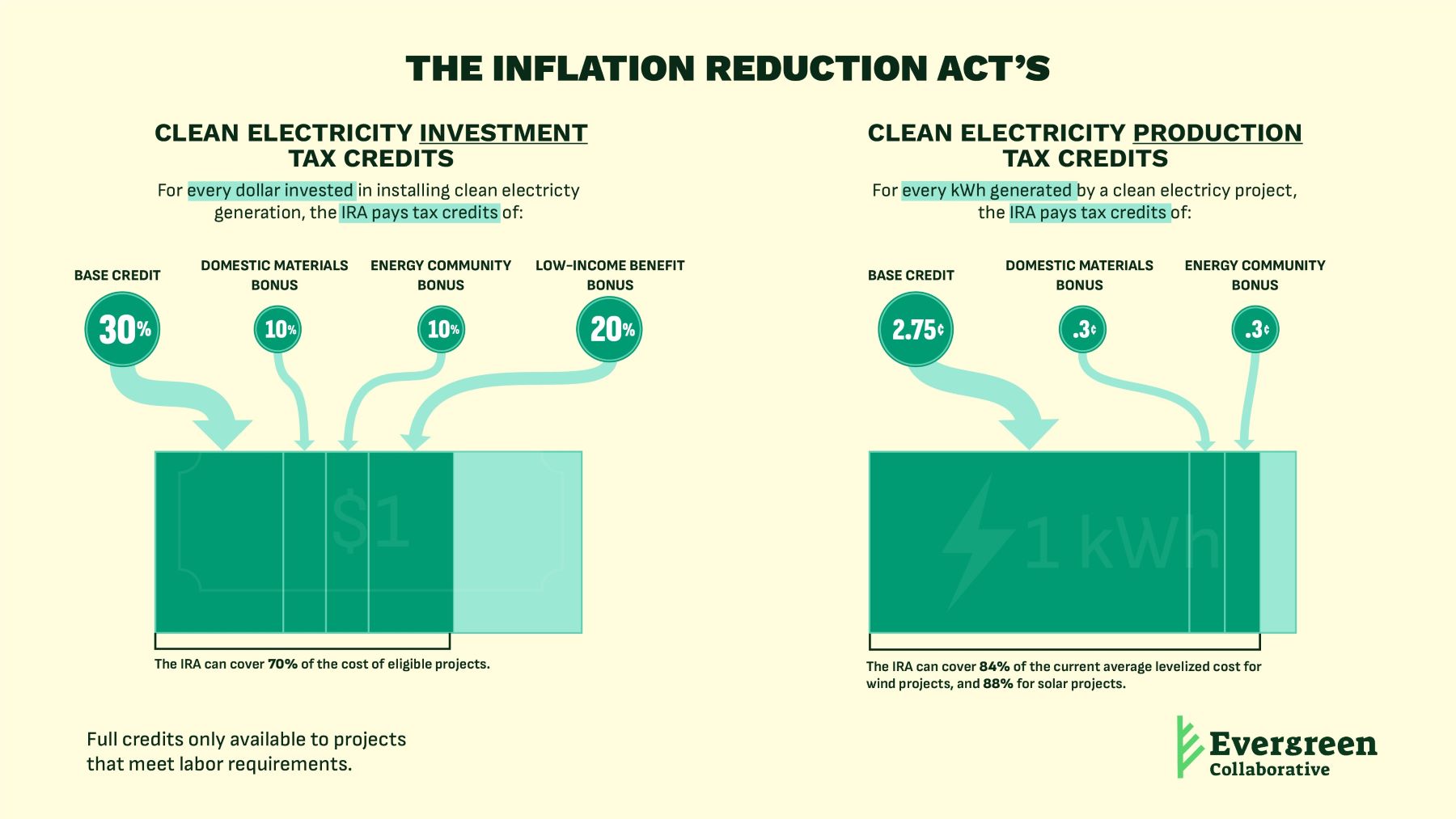

As the name suggests, the clean electricity production tax credit subsidizes the production of clean electricity. Similarly, the clean electricity investment tax credit supports new investment in clean electricity installations. A given project can only receive the PTC or ITC, but not both. The credits’ shared purpose—boosting the installation and operation of new clean power sources—is clear. But the devil is in the details.

With the ITC, project developers can receive a base credit worth 30 percent of the project’s value, provided they meet certain labor standards (more on that in a second). In a market where wind and solar are already the world’s cheapest energy sources and getting cheaper, this substantial subsidy will make new generation all the more appealing to project developers. And the updated credit supports more than wind and solar power: For the first time, the ITC is now available for energy storage technologies, which are critical for achieving a stable clean grid.

The PTC, on the other hand, awards credits to clean energy sources on a per-kilowatt-hour basis. For every kWh of clean energy generated, the producer gets a base credit of 2.6¢/kWh (again, provided they meet certain labor standards). Historically that’s been roughly equivalent in value to the 30 percent ITC. Subsidizing production per-unit creates a strong incentive to generate as much clean power as possible, with operating costs defrayed along the way.

What projects are eligible? |

|

ITC or PTC Eligible

|

multiple solar and wind technologies, municipal solid waste, geothermal (electric), and tidal |

ITC Eligible

|

energy storage technologies, microgrid controllers, fuel cells, geothermal (heat pump and direct use), combined heat & power, microturbines, and interconnection costs |

PTC Eligible

|

biomass, landfill gas, hydroelectric, marine and hydrokinetic |

| Source: EPA | |

This is roughly how the ITC and PTC have always operated, but for the first time the IRA extends these credits for a full ten-years, and beyond, at their full value. The IRA also makes some important upgrades. Those changes will redefine the credits’ impact on the clean energy economy.

How does the IRA upgrade the ITC and PTC?

1. Ambitious labor standards

New labor stipulations are among the IRA’s most significant changes to the ITC and PTC. Originally, projects were eligible for the base credits of 30 percent and 2.75¢/kWh with no strings attached. Now, developers and operators have to pay prevailing wages and hire apprentices to qualify for the full credit value. If they don’t, they receive much, much smaller credit shares—a modest 6 percent and 0.5¢/kWh, respectively. (Smaller projects aren’t subject to this standard to receive the base credit.) Tying the full credit value to labor practices, as pioneered by Washington’s Clean Energy Transformation Act signed by Governor Jay Inslee in 2019, is a major incentive to create good jobs in the clean energy economy.

The prevailing wage provision requires that all wages for construction, alteration, and repair for the first five years of an ITC project and the first 10 years of a PTC project must be paid at the prevailing wage. Prevailing wages, calculated on a state and regional basis, are the average wage paid to workers in a given occupation in a geographic area. This requirement ensures that clean energy workers are paid a fair, liveable wage.