Clean energy tax credits, within the Inflation Reduction Act (IRA), like the Low-Income Communities Bonus Credit, Investment Tax Credit (ITC), and the Production Tax Credit (PTC) subsidize the production of clean energy, like solar, wind, and geothermal, which translates to lower energy costs for families, cleaner air and water, and less climate pollution.

Buildings credits like the Energy Efficient Home Improvement Credit and the New Energy Efficient Homes Credit allow homeowners and businesses to upgrade buildings to be more efficient, healthier, and weather-resilient. And programs like the Low-Income Home Energy Assistance Program (LIHEAP) help millions of families afford their utility bills.

The Greenhouse Gas Reduction Fund (GGRF) lowers energy costs for American households, reduces reliance on fossil fuels, and stabilizes energy prices by investing in clean energy projects and energy efficiency upgrades.

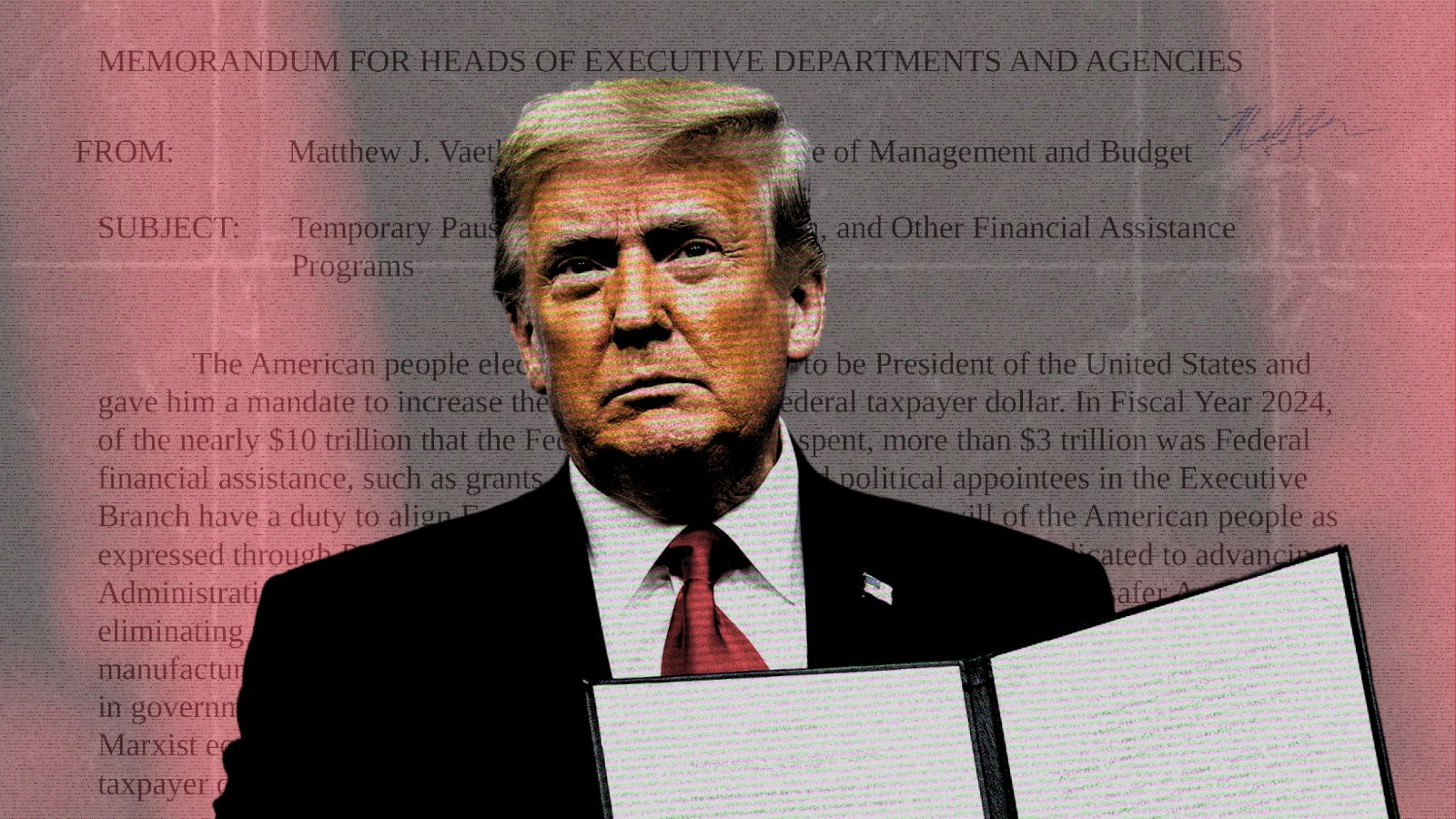

Trump and MAGA Republicans in Congress’ are attempting to eliminate or undermine these efficient, effective programs, threatening these cost savings and hindering a transition to a cleaner and more affordable energy future.

Read more about the impactful clean energy programs the GOP is trying to cut.

Read more about how GGRF is supporting communities and cutting costs.

.jpg)